India Car Loan Market Share, Growth, Insights and Research Report 2025-2033

India Car Loan Market Overview

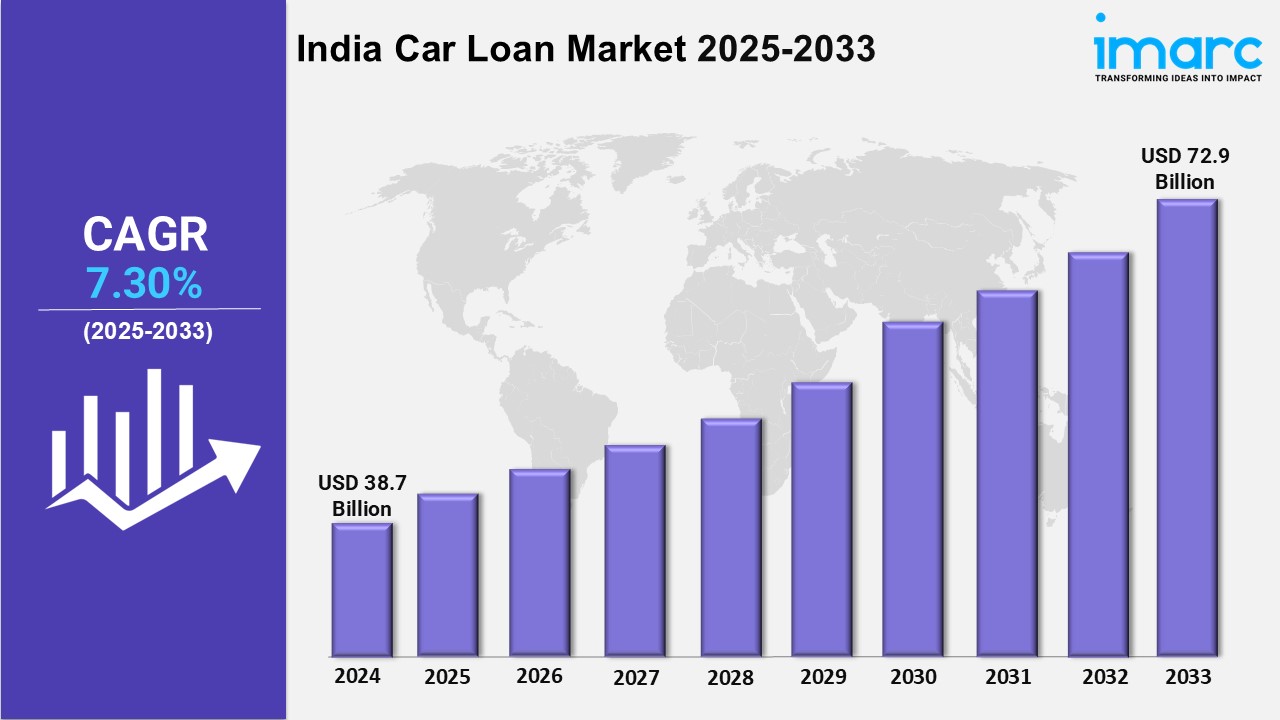

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 38.7 Billion

Market Forecast in 2033: USD 72.9 Billion

Market Growth Rate: 7.30% (2025-2033)

The India car loan market size was valued at USD 38.7 Billion in 2024 and is expected to reach USD 72.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.30% during 2025-2033.

India Car Loan Market Trends:

The Indian car loan market is experiencing significant evolution, shaped by changing consumer behavior and digital disruption. A key trend is the rise of pre-approved loans, where banks leverage AI-driven credit scoring to offer instant financing options through mobile apps and online platforms. Moreover, flexible repayment structures are gaining popularity, with lenders introducing balloon payments and step-up EMIs to cater to young professionals and gig economy workers. In addition, fintech partnerships are transforming the landscape, as NBFCs collaborate with digital marketplaces to offer seamless loan comparisons and paperless approvals. Furthermore, the growing preference for used car loans is expanding the market, driven by urbanization and cost-conscious buyers seeking value deals.

Basically, customized loan products are emerging, with tenure extensions, seasonal offers, and loyalty benefits becoming standard across lenders. Notably, EV-focused financing schemes are gaining traction, featuring lower interest rates and longer moratorium periods to accelerate electric vehicle adoption. Additionally, alternative credit assessment models are enabling wider access, using non-traditional data like utility payments and social behavior to serve thin-file customers. The market is also witnessing a surge in co-lending arrangements, where banks and fintechs combine strengths to reach underserved rural and semi-urban segments.

Request for a sample copy of this report: www.imarcgroup.com/i...

India Car Loan Market Scope and Growth Analysis:

India’s car loan market is poised for robust expansion, fueled by rising disposable incomes and increasing vehicle ownership aspirations. Moreover, the penetration of digital lending ecosystems is democratizing access, with end-to-end online processes reducing turnaround times from days to hours. In addition, product innovation is unlocking new segments, such as subscription-based models and lease-to-own options appealing to millennials. Furthermore, the integration of blockchain is enhancing transparency, streamlining KYC processes and reducing fraud risks in loan disbursals. Basically, the expansion of captive financing by automakers is intensifying competition, with OEMs offering bundled insurance and maintenance packages.

The market is also benefiting from government initiatives promoting financial inclusion and easier credit access for first-time buyers. With rising used-car sales, lenders are developing specialized valuation tools and extended warranty-linked loans to mitigate asset risks. Strategic focus on tier-2/3 city expansion, dynamic risk-based pricing, and omnichannel customer engagement will be pivotal to sustaining growth. Overall, the convergence of demographic advantages, technological enablement, and diversified product offerings positions India’s car loan market for long-term, sustainable growth.

India Car Loan Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India car loan market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Type Insights:

New Car

Used Car

Car Type Insights:

SUV

Hatchback

Sedan

Provider Type Insights:

OEM (Original Equipment Manufacturers)

Banks

NBFCs (Non Banking Financials Companies)

Tenure Insights:

Less Than 3 Years

3-5 Years

More Than 5 Years

Regional Insights:

North India

South India

East India

West India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Market Dynamics

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Top Winning Strategies

Recent Industry News

Key Technological Trends & Development

Ask an analyst: www.imarcgroup.com/r...

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!