Top 5 Crypto Arbitrage Bots Compared – Which One Wins?

Introduction

Cryptocurrency trading is evolving rapidly, and traders are constantly looking for ways to maximize their profits. One such method is crypto arbitrage, which involves taking advantage of price differences across exchanges. However, manually executing arbitrage trades can be challenging and time-consuming. This is where crypto arbitrage bots come into play.

These automated crypto arbitrage bots help traders execute trades within milliseconds, reducing the risk of missing profitable opportunities. In this article, we compare the top 5 crypto arbitrage bots, analyzing their features, pricing, pros, and cons. By the end of this guide, you’ll know which bot best suits your trading strategy.

What is Crypto Arbitrage?

Crypto arbitrage is a trading strategy that exploits price discrepancies of a cryptocurrency across different exchanges. The goal is to buy low on one exchange and sell high on another, making a profit from the spread.

Types of Crypto Arbitrage

Spatial Arbitrage: Buying and selling crypto on different exchanges.

Triangular Arbitrage: Exploiting price differences between three currency pairs on the same exchange.

Statistical Arbitrage: Using historical data and machine learning to predict price inefficiencies.

Cross-Border Arbitrage: Capitalizing on price differences between international exchanges.

For an in-depth explanation of crypto arbitrage strategies, check out Coinqueen’s guide.

Why Use Crypto Arbitrage Bots?

crypto arbitrage bots automate the process, allowing traders to capitalize on opportunities without constantly monitoring the markets. Some key benefits include:

Speed: Executes trades in milliseconds.

Efficiency: Analyzes multiple exchanges simultaneously.

Risk Reduction: Eliminates emotional trading and human errors.

24/7 Trading: Monitors the market round the clock.

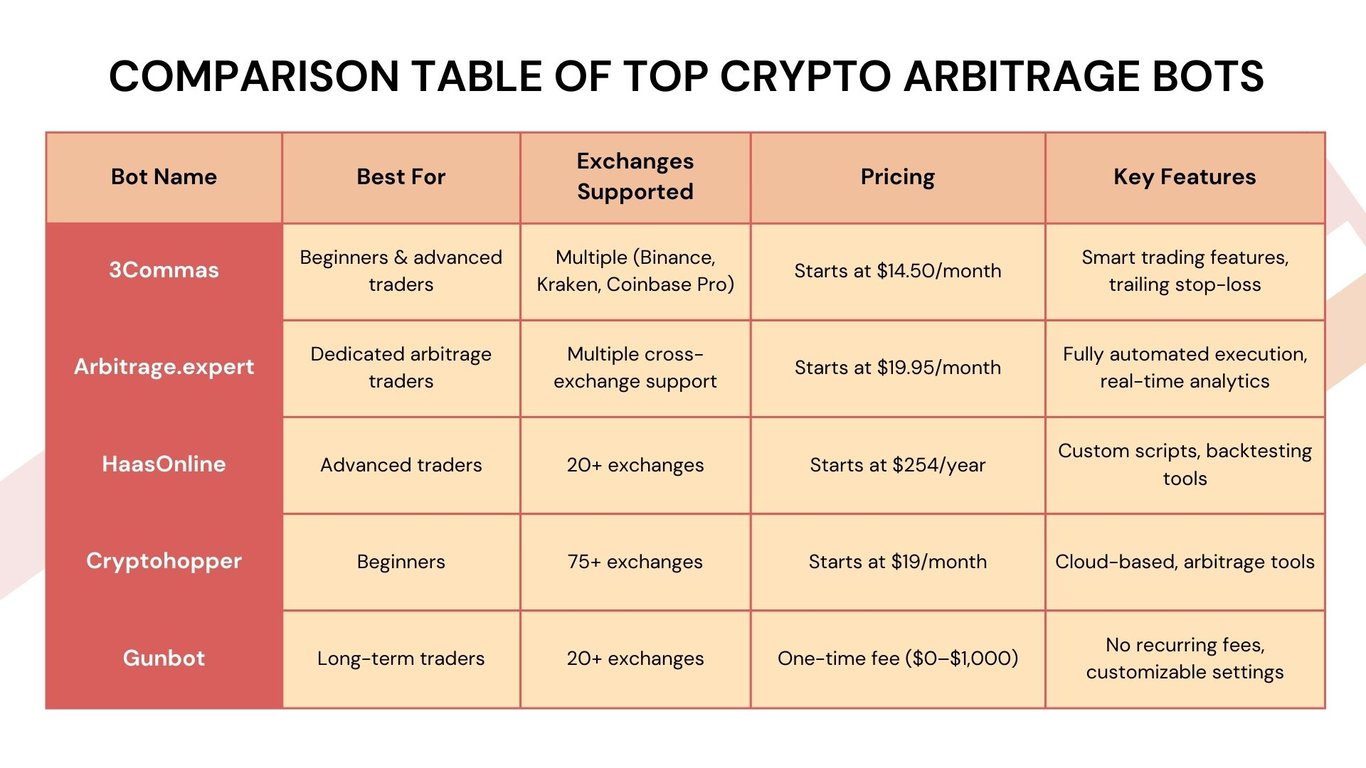

Top 5 Crypto Arbitrage Bots Compared

1. 3Commas

Overview: 3Commas is a powerful trading platform that includes crypto arbitrage trading capabilities.

Features:

Supports multiple exchanges, including Binance, Kraken, and Coinbase Pro.

Smart trading features like trailing stop-loss.

Customizable automated trading strategies.

Pricing: Starts at $14.50/month.

Pros:

User-friendly interface.

Great for both beginners and advanced traders.

Cons:

Limited crypto arbitrage functionalities compared to specialized bots.

2. Arbitrage.expert

Overview: A dedicated crypto arbitrage bot designed for real-time arbitrage trading.

Features:

Fully automated crypto arbitrage execution.

Cross-exchange support with real-time analytics.

Advanced algorithmic trading features.

Pricing: Starts at $19.95/month.

Pros:

Specially designed for crypto arbitrage.

24/7 monitoring and trading.

Cons:

Higher learning curve for beginners.

Learn more about Arbitrage.expert

3. HaasOnline

Overview: HaasOnline is one of the most advanced crypto arbitrage botsavailable.

Features:

Supports 20+ exchanges.

Advanced backtesting for crypto arbitrage strategies.

Custom script-based trading automation.

Pricing: Starts at $254/year.

Pros:

Highly customizable.

Excellent backtesting tools.

Cons:

Expensive for beginners.

4. Cryptohopper

Overview: A popular cloud-based crypto arbitrage bot with built-in arbitrage tools.

Features:

Supports over 75 exchanges.

Crypto arbitrage between multiple exchanges.

No downtime due to cloud-based setup.

Pricing: Starts at $19/month.

Pros:

Affordable for beginners.

Easy-to-use interface.

Cons:

Limited features in the basic plan.

5. Gunbot

Overview: An advanced crypto arbitrage bot that supports multiple trading strategies.

Features:

Customizable crypto arbitrage settings.

Works with 20+ exchanges.

One-time payment option.

Pricing: One-time payment from $0–$1,000 depending on the version.

Pros:

No recurring subscription fees.

Highly customizable.

Cons:

Requires technical knowledge to set up.

Future of Crypto Arbitrage Bots

The future of crypto arbitrage botslooks promising, with advancements in AI, machine learning, and blockchain interoperability. Future bots will likely offer:

Faster trade execution with improved algorithms.

Integration with DeFi for more crypto arbitrage opportunities.

Enhanced security to prevent hacks and exploits.

More accessibility through user-friendly interfaces.

How to Create Your Own Crypto Arbitrage Bot

Interested in building your own crypto arbitrage bot? Here’s a simple roadmap:

Choose a Programming Language (Python, JavaScript, or C++)

Use APIs to connect with crypto arbitrage exchanges

Implement Trading Strategies (e.g., triangular or spatial arbitrage)

Backtest the Bot using historical market data

Optimize for Speed to minimize slippage

Secure Your Bot with encryption and authentication mechanisms

For custom-built crypto arbitrage bot development, check out our services at Our Company.

Conclusion

Crypto arbitrage bots help traders take advantage of price differences across exchanges, automating the process for efficiency and speed. As the market evolves, traders who leverage these bots will have a competitive edge.

Interested in developing your own custom crypto arbitrage bot? Our company specializes in creating high-performance crypto arbitrage bots tailored to your needs. Contact us today for a consultation!

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!