Invoice Factoring Market Industry Overview and Market Landscape 2025-2032

Invoice Factoring Market: Evolving Trends, Drivers, and Regional Insights

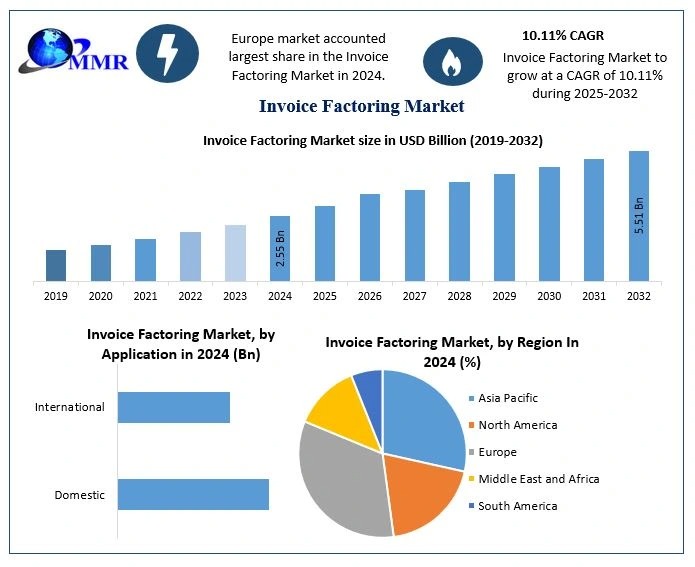

The Invoice Factoring Market size was valued at USD 2.55 Billion in 2024 and the total Invoice Factoring revenue is expected to grow at a CAGR of 10.11% from 2025 to 2032, reaching nearly USD 5.51 Billion.

Market Overview:

The Invoice Factoring Market continues to gain strong traction as businesses focus on maintaining consistent cash flow instead of relying on long term financing solutions. Companies operating in sectors such as manufacturing, logistics, healthcare, retail, and professional services are increasingly adopting invoice factoring to streamline receivables management. With quicker access to funds and a straightforward process, invoice factoring supports organizations that need liquidity to manage day to day operations without payment delays.

A key strength of the Invoice Factoring Market lies in its flexibility to accommodate varying business requirements. Service providers design customized factoring solutions based on industry type, client profiles, and invoicing patterns. This adaptable approach enables businesses to align financing with their growth plans and operational needs. Growing awareness and the rise of digital platforms have further simplified access, reinforcing confidence in invoice factoring among businesses of all scales.

Get a Free Sample Market Report Link :https://www.maximizemarketresearch.com/request-sample/168342/

Key Market Drivers:

One of the strongest drivers of the Invoice Factoring Market is the growing need for uninterrupted cash flow. Many businesses face delayed payments that disrupt daily operations, payroll management, and supplier relationships. Invoice factoring addresses this challenge by releasing funds tied up in receivables, enabling companies to operate without financial strain.

Another important driver is the shift away from traditional bank loans. Lengthy approval processes, strict eligibility requirements, and inflexible repayment structures have pushed businesses toward alternative financing options. The Invoice Factoring Market offers faster approvals and greater flexibility, making it more accessible for growing companies and startups.

Digital transformation is also accelerating the Invoice Factoring Market. Technology driven platforms streamline invoice verification, risk assessment, and fund disbursement. This efficiency reduces administrative burden and enhances transparency, making invoice factoring more appealing to modern businesses seeking quick and secure financial solutions.

Market Outlook and Future Trends

The future of the Invoice Factoring Market looks promising as businesses increasingly adopt agile financial strategies. Demand is expected to remain strong as economic uncertainty encourages companies to seek dependable liquidity solutions. Invoice factoring is no longer viewed as a temporary fix but as a strategic financial tool that supports long term growth.

Innovation is shaping the evolution of the Invoice Factoring Market. Advanced analytics, automation, and digital onboarding are improving service efficiency and customer experience. As providers integrate artificial intelligence and real time data insights, risk management becomes more precise, benefiting both clients and factoring companies. These advancements are expected to strengthen trust and expand adoption across industries.

What is Invoice Factoring Market Regional Insight?

Market regional insight in the Invoice Factoring Market highlights varying adoption patterns across different regions. Developed economies show strong usage due to mature financial ecosystems and widespread awareness of alternative financing. Businesses in these regions value invoice factoring for its speed and operational flexibility.

Request Your Sample Market Report PDF :https://www.maximizemarketresearch.com/request-sample/168342/

What is Invoice Factoring Market Segmentation?

The Invoice Factoring market can be segmented based on multiple factors to provide a detailed understanding of market structure and performance:

by Type

Recourse Factoring

Non-recourse Factoring

by Application

Domestic

International

by Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

by Provider

Banks

NBFCs

by Industry Vertical

Construction

Manufacturing

Healthcare

Transportation and Logistics

Energy and Utilities

IT and Telecom

Staffing

Others

This segmentation analysis helps stakeholders identify high-growth segments and formulate effective market entry and expansion strategies.

Some of the Current Players in the Invoice Factoring Market are:

1.Porter Capital

2. Adobe

3. Barclays Bank UK PLC

4. ICBC

5. Intuit Inc.

6. American Express Company

7. Lloyds Bank

8. Sonovate

9. Waddle

10. Velotrade

11. eCapital

12. Triumph Business Capital

13. Breakout Capital

14. Nav

Market players are focusing on strategic partnerships, mergers & acquisitions, and product innovation to strengthen their market presence and expand their global footprint.

Explore More Related Reports:

For additional insights and reports on related industries and markets, visit our website to stay updated with the latest market research and industry developments.

global Laser Projection Market www.maximizemarketre...

Global Liquid Crystal on Silicon (LCoS) Market www.maximizemarketre...

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarket...

🌐 www.maximizemarketre...