Philippines IT Training Market Size, Share, Trends & Outlook 2025-2033

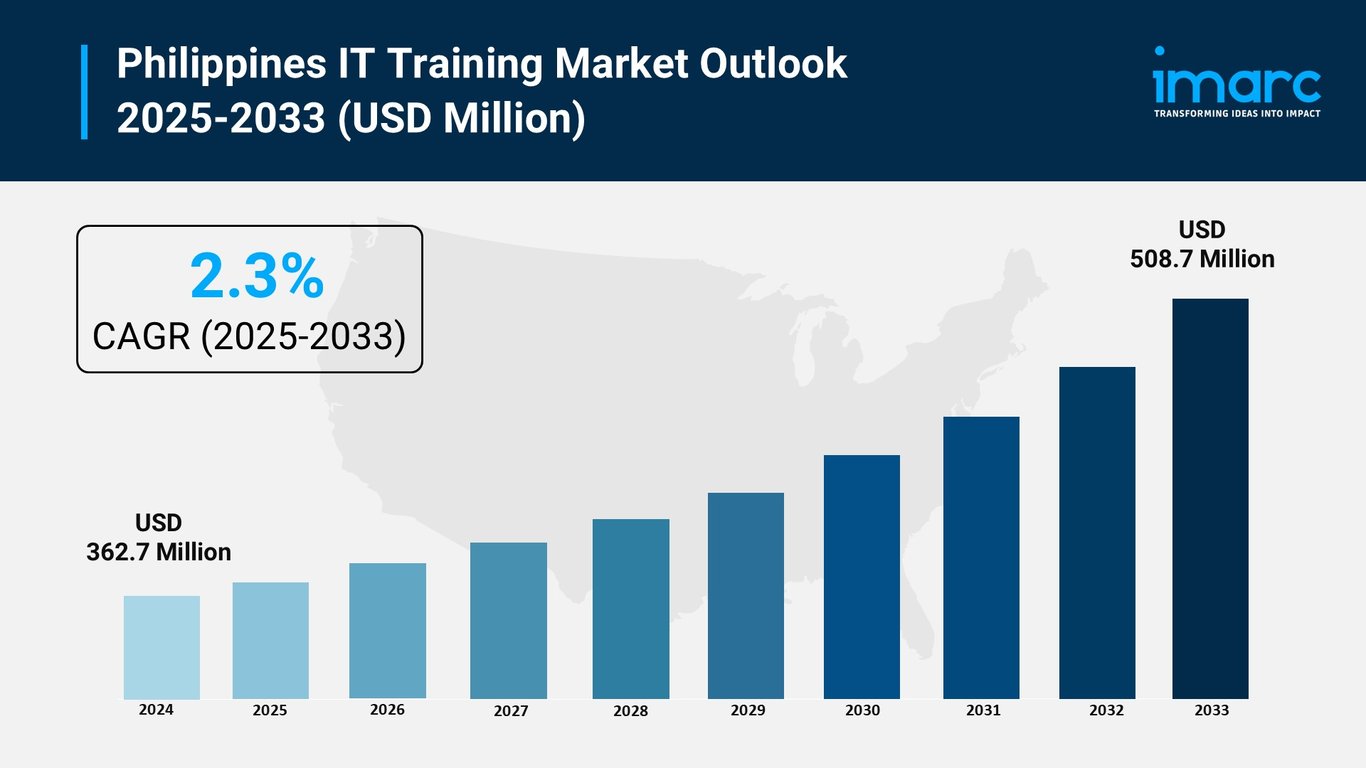

The latest report by IMARC Group, "Philippines IT Training Market Report by Delivery Mode (Online Training, Offline Training), Application (IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, and Others), End User (Corporate, Schools and Colleges, and Others), and Region 2025-2033," provides an in-depth analysis of the Philippines IT training market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines IT training market size reached USD 362.7 Million in 2024 and is projected to grow to USD 508.7 Million by 2033, exhibiting a growth rate of 2.3% during the forecast period.

Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 362.7 Million

Market Forecast in 2033: USD 508.7 Million

Growth Rate (2025-2033): 2.3%

Philippines IT Training Market Overview:

The Philippines IT training market is driven by rapid technological advancements increasing demand skilled IT professionals corporate digital transformation initiatives rise e-learning platforms continuous education requirements upskilling reskilling competitive job market. February 2025 50 percent employees will need reskilling keeping up evolving job market presenting challenge opportunity. Digital economy projected USD 21 billion by 2025 with tech jobs Manila growing 28 percent in 2024. National ICT Month 2025 focused upskilling MSMEs with DICT ICT Literacy Competency Development Bureau supporting access digital marketing tools cybersecurity digital literacy training cloud platforms. Republic Act 11927 Philippine Digital Workforce Competitiveness Act creating framework bridging digital-skills gap focusing upskilling reskilling Filipino workforce. 75 percent employers requiring digital skills new hires with 8 out 10 positions demanding basic digital competency supporting sustained market expansion nationwide.

Request For Sample Report: www.imarcgroup.com/p...

Philippines IT Training Market Trends:

Philippines IT training market trends indicate shift toward online blended learning models greater focus emerging technologies AI cloud computing rise micro-credentialing industry-specific IT training corporate upskilling programs gaining momentum. National ICT Month 2025 focused upskilling MSMEs with Digital Bayanihan movement motto "No Filipino too far no community too small" vision covering country northernmost southernmost parts. May 2025 DOST launched second phase digital literacy training program aimed strengthening MSMEs region through partnership Isabela State University Business Intelligence Research Development Center. July 2025 DTI Negros Occidental introduced career certificate programme providing accessible free flexible online training key digital skills tailored MSMEs owners groups facing barriers accessing formal education. DICT SPARK initiative aligning with RA 11927 equipping Filipinos advanced skills cybersecurity artificial intelligence Internet drones electric vehicles electric mobility areas digital technology. Learning Management Systems virtual classrooms blended learning becoming norm with schools investing tech-based upskilling programs better preparing workplace.

Philippines IT Training Market Drivers:

Drivers include rising demand skilled IT professionals with Philippines experiencing significant increase need due ongoing growth outsourcing software development digital services sectors. 75 percent employers requiring digital skills new hires with data shortage 200,000 jobs cannot filled including IT business analytics management software development cybersecurity according JobStreet. Government actively pursuing initiatives bolstering digital literacy technical competencies with nationwide IT training scholarships collaborations technology providers enhancing talent pool. DICT partnered Google Philippines providing cybersecurity scholarships qualified applicants self-paced program equipping government employees skills needed entry-level cybersecurity jobs. DSWD advancing digital financial literacy among Pantawid Pamilyang Pilipino Programme 4Ps beneficiaries with E-Panalo ang Kinabukasan initiative training 252 beneficiaries managing digital transactions. Swift adoption advanced technologies AI cloud computing cybersecurity reshaping skill demands with organizations channeling investments training programs specialized fields supporting sustained market growth nationwide.

Market Challenges:

• Skills Gap significant disparity between academic curricula rapidly evolving IT sector demands affecting workforce readiness

• Rural Access numerous rural remote areas encountering obstacles accessing quality IT training due inadequate internet connectivity

• High Certification Costs advanced IT certification programs steep tuition costs prohibitive many students small businesses

• Infrastructure Limitations insufficient modern computer facilities shortage qualified trainers impeding skill development outside urban centers

• Curriculum Lag conventional education systems difficulty keeping pace emerging technologies AI blockchain cloud computing

• Digital Divide issues governance infrastructure digital literacy benefits digitalization remaining inaccessible many particularly underserved regions

• Retention Challenges employee retention practical challenge with high turnover rates resulting lost productivity increased hiring costs

• Quality Consistency varying quality training programs across providers affecting learning outcomes employment prospects

Market Opportunities:

• Government Programs capitalizing on SPARK initiative DICT Tech4ED Digital Transformation Centers nationwide implementation

• Emerging Technologies developing specialized training AI machine learning cloud computing cybersecurity data analytics blockchain

• Public-Private Partnerships collaborating government entities industry players educational institutions creating customized market-aligned programs

• Online Learning Expansion leveraging e-learning platforms providing accessible flexible cost-effective training nationwide

• MSME Focus targeting micro small medium enterprises digital literacy upskilling through specialized programs partnerships

• Certification Programs offering globally recognized certifications through partnerships international technology companies

• Rural Penetration expanding training infrastructure underserved geographically isolated disadvantaged areas improving inclusivity

• Corporate Training developing customized competency-based programs addressing precise employer needs improving employability

Philippines IT Training Market Segmentation:

By Delivery Mode:

Online Training

Offline Training

By Application:

IT Infrastructure Training

Enterprise Application and Software Training

Cyber Security Training

Database and Big Data Training

Others

By End User:

Corporate

Schools and Colleges

Others

By Regional Distribution:

Luzon

Visayas

Mindanao

Philippines IT Training Market News:

July 2025: Department of Trade and Industry Negros Occidental introduced career certificate programme providing accessible free flexible online training key digital skills. Programme tailored micro small medium enterprises MSMEs owners well groups often facing barriers accessing formal education training opportunities. Initiative part Philippines digital transformation agenda promoting digital inclusion skills development empowering small businesses equipping essential digital competencies supporting inclusive growth across country.

May 2025: Department of Science and Technology launched second phase digital literacy training program aimed strengthening MSMEs region through partnership Isabela State University Business Intelligence Research Development Center. Project SETUP Adopter's Digital Literacy Skills and Consultancy Towards Development SMARTER MSMEs Cagayan Valley part DOST Small Enterprise Technology Upgrading Program seeking accelerate digital transformation local businesses enhance competitiveness resilience following SMARTER framework Sustainable Market-oriented Agile Resilient Technology-empowered Entrepreneurial Resource-efficient.

February 2025: National ICT Month 2025 concluded with major focus upskilling micro small medium enterprises MSMEs according DICT Undersecretary Christina Faye Condez-De Sagon. ICT Literacy Competency Development Bureau supports MSMEs providing access digital marketing tools cybersecurity digital literacy training cloud platforms through Tech4ED digital transformation centres. Digital Bayanihan movement promoting "No Filipino too far no community too small" vision covering northernmost southernmost Philippines empowering families improving livelihoods bringing hope demonstrating government commitment digital inclusivity nationwide.

Key Highlights of the Report:

Market analysis projecting growth from USD 362.7 million (2024) to USD 508.7 million (2033) with 2.3% CAGR

Digital economy projected USD 21 billion by 2025 with tech jobs Manila growing 28% in 2024

February 2025 50% employees will need reskilling by 2025 keeping up evolving job market

75% employers requiring digital skills new hires with 8 out 10 positions demanding basic digital competency

Data shortage 200,000 jobs cannot filled including IT business analytics software development cybersecurity

National ICT Month 2025 focused upskilling MSMEs with Digital Bayanihan movement nationwide coverage

DICT SPARK initiative aligning RA 11927 Philippine Digital Workforce Competitiveness Act framework

Only 40% Filipinos currently possess basic ICT skills creating massive opportunity for upskilling

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines IT training market growth to USD 508.7 million by 2033?

A1: Market driven by digital economy projected USD 21 billion by 2025, tech jobs Manila growing 28%, 75% employers requiring digital skills, data shortage 200,000 unfilled jobs, National ICT Month 2025 upskilling MSMEs focus, DICT SPARK initiative aligning RA 11927 framework, February 2025 50% employees needing reskilling, swift adoption AI cloud computing cybersecurity technologies supporting 2.3% CAGR addressing workforce development digital competency requirements nationwide.

Q2: How are government initiatives and technology integration transforming the Philippines IT training landscape?

A2: National ICT Month 2025 focused upskilling MSMEs Digital Bayanihan movement nationwide coverage. May 2025 DOST launched second phase digital literacy program SMARTER MSMEs framework. July 2025 DTI introduced career certificate programme accessible free flexible online training. DICT SPARK aligning RA 11927 equipping cybersecurity AI Internet drones skills. DICT Google partnership providing cybersecurity scholarships. Learning Management Systems virtual classrooms becoming norm supporting market maturation digital transformation nationwide.

Q3: What opportunities exist for IT training stakeholders in emerging Philippines market segments?

A3: Opportunities include government programs capitalizing SPARK Tech4ED Digital Transformation Centers, emerging technologies developing specialized training AI machine learning cloud computing cybersecurity, public-private partnerships collaborating government industry educational institutions, online learning expansion leveraging e-learning platforms nationwide accessibility, MSME focus targeting digital literacy upskilling specialized programs, certification programs offering globally recognized credentials international partnerships, rural penetration expanding underserved areas, and corporate training developing customized competency-based programs supporting market diversification addressing IT training innovation demands.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: www.imarcgroup.com/r...

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302